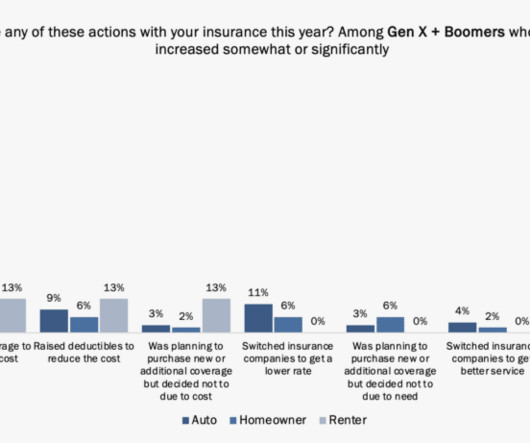

Are Insurance Price Increases a Tipping Point for Gen X and Boomers?

Majesco

MARCH 27, 2025

Auto insurance repair costs align strongly with the number of claims, increasing and driving up insurance costs. Weather and catastrophic events, crime, more frequent and larger lawsuits, and high-tech vehicles also contribute significantly to their perceptions of what is driving up auto insurance costs.

Let's personalize your content