Helping Clients Navigate Marketplace Open Enrollment | Solstiuce

Solstice Insurance Broker

JANUARY 23, 2025

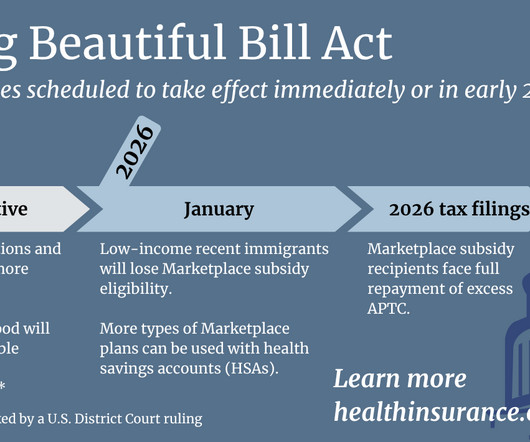

As an insurance broker, you can be the compass your clients need. Key Takeaways : Brokers should stay informed to empower their clients. Key Takeaways : Brokers should stay informed to empower their clients. Brokers should advocate for clients year-round, assisting with claims and policy updates.

Let's personalize your content