API 101: Functionality & Benefits for the Insurance Industry

Zywave

MARCH 19, 2025

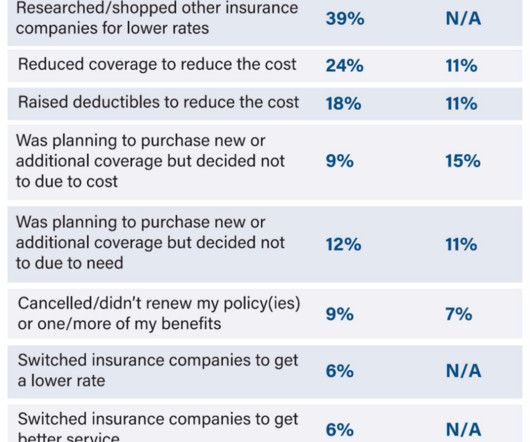

Benefits of APIs in the Insurance Industry APIs offer numerous benefits to the insurance industry, enhancing efficiency, customer experience, and data management. APIs facilitate instant updates and communication, such as sending policy updates or claim status notifications, enhancing transparency and trust.

Let's personalize your content