Why Business insurance?

Shield Insurance Agency

JUNE 19, 2025

Business insurance protects you/your business against various risks and potential financial losses that can arise from unexpected events or claims.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Shield Insurance Agency

JUNE 19, 2025

Business insurance protects you/your business against various risks and potential financial losses that can arise from unexpected events or claims.

Boyle Agency Insurance

APRIL 4, 2025

Imagine a scenario where a contractor accidentally damages your property or a worker gets injured while working on your home. It ensures that the contractor is financially equipped to handle damages or injuries that may occur on-site. Without proper insurance, you could be held liable.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect Commercial Insurance

JULY 18, 2025

It’s not about doing something on purpose – it’s about carelessness that leads to damage. And finally, there must be damages – a real injury or financial loss. Even if you never intended harm, a single incident can lead to hefty legal fees, compensation payouts, reputational damage and higher premiums in future.

Distinguished

MARCH 20, 2025

Unlike single-family homes, apartment complexes face heightened risks damage from one unit can quickly spread to others, liability claims can stem from common areas, and evolving building codes can demand costly upgrades. Without the right coverage, property owners could be exposed to significant financial and legal risks.

Protect Commercial Insurance

MAY 9, 2025

From unforeseen damage to potential customer mishaps, there’s a lot to consider to keep your business running smoothly. Protecting Your Business from Financial Losses Imagine a scenario: it’s a typical busy Friday afternoon, your shop is bustling with customers, and suddenly, an unexpected incident occurs.

Distinguished

MAY 19, 2025

To stay resilient, restaurant owners need insurance that helps them recover quickly and mitigate financial losses when something goes wrong. General liability coverage protects against third-party claims involving bodily injury, property damage, or advertising injury from slip-and-fall accidents to food-related complaints.

Protect Commercial Insurance

JUNE 20, 2025

Here are some key components typically included: – Property Insurance : Protects the physical premises and its contents from damage or loss due to incidents like fire, flood, or vandalism. – Public Liability Insurance : Protects against claims made by third parties for injuries or damages occurring on your office premises.

ProWriters

JULY 16, 2025

Such measures won’t undo the attack but may help mitigate the damage done. What Small Businesses Should Do When Cyber Criminals Strike If your small-business client already has a cyber incident response plan , they should execute it as soon as they know an attack has occurred. Determine the source and extent of the attack.

Simply Insurance

JUNE 12, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy North Carolina Rental Insurance?

Simply Insurance

JUNE 10, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy New Hampshire Rental Insurance?

Simply Insurance

JUNE 11, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy West Virginia Rental Insurance?

Shield Insurance Agency

MARCH 31, 2025

Running a warehouse in Michigan involves managing a variety of risks, from property damage to employee injuries. Warehouse Operations in Michigan: A Risk Landscape Warehouses face a unique set of risks, including damage to goods, equipment breakdown, and liability issues. This is where commercial insurance comes in.

Simply Insurance

JUNE 9, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Minnesota Rental Insurance?

Simply Insurance

JUNE 12, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Wyoming Rental Insurance?

Simply Insurance

JUNE 10, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Maryland Rental Insurance?

Simply Insurance

JUNE 10, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Louisiana Rental Insurance?

Simply Insurance

JUNE 11, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Wisconsin Rental Insurance?

Simply Insurance

JUNE 11, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy New York Rental Insurance?

Simply Insurance

JUNE 12, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Oklahoma Rental Insurance?

Simply Insurance

JUNE 9, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Connecticut Rental Insurance?

Simply Insurance

JUNE 9, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy DC Rental Insurance?

Simply Insurance

JUNE 10, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Arkansas Rental Insurance?

Simply Insurance

JULY 1, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy Alabama Rental Insurance?

Simply Insurance

JUNE 10, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy New Jersey Rental Insurance?

Simply Insurance

JUNE 14, 2025

Cyber insurance policies protect you against lawsuits, employee mistakes, cyber security attacks, and reputation damage. Business Interruption Business interruption coverage compensates businesses for lost income due to cyber incidents. It helps maintain financial stability during recovery periods.

Property Insurance Centre

FEBRUARY 24, 2025

From financial losses to reputational damage, legal battles, and even the risk of shutting down, the impact can be severe. The Financial Toll of a Liability Claim A lawsuit can lead to crippling legal expenses, compensation payouts, and increased insurance premiums.

Simply Insurance

JUNE 12, 2025

This implies the policy will pay for only those events expressly included in the coverage wording, and your insurance coverage will not compensate for anything else. An Open Peril Policy means your coverage will cover damage caused by anything other than items on the prohibited list. Who Should Buy New Mexico Rental Insurance?

Distinguished

FEBRUARY 24, 2025

Whether it is a major fire or foodborne illnesses , restaurants in Charlotte and North Carolina need comprehensive insurance coverage to help them financially recover from unexpected and financially devastating events. General liability insurance: Coverage for legal claims related to customer injuries or property damage.

Distinguished

JULY 9, 2025

If the owner violates the terms of the license, the city can make a claim on the bond to recover damages or penalties. These contract surety bonds protect the obligee (in this case, the city) from financial loss if the contractor fails to deliver on time, within budget, or according to specifications.

Distinguished

JULY 9, 2025

If the owner violates the terms of the license, the city can make a claim on the bond to recover damages or penalties. These contract surety bonds protect the obligee (in this case, the city) from financial loss if the contractor fails to deliver on time, within budget, or according to specifications.

Jackson & Jackson

NOVEMBER 16, 2024

Professional Liability Insurance protects your business against claims of negligence, errors, or omissions that result in financial losses for your clients. If a client trips over cables during a meeting at your office or your equipment damages their property, General Liability Insurance provides coverage.

Protect Commercial Insurance

SEPTEMBER 20, 2024

It covers you against claims of property damage, personal injury, or negligence. This type of insurance is designed to cover you if a member of the public suffers an injury or their property is damaged because of your business activities. It covers the cost of compensation and associated legal fees if an employee decides to sue.

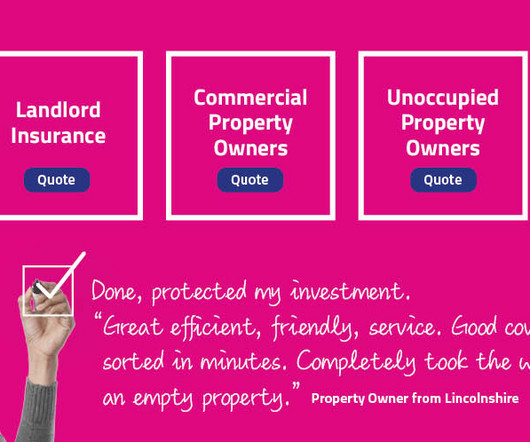

Cover4LetProperty

OCTOBER 1, 2024

While landlord insurance typically isn’t a legal requirement, if you have a mortgage on the property, then in most cases you will be legally obliged to ensure you have (at the very least) adequate landlords buildings insurance to protect both you and your mortgage provider’s financial interests in the property.

Protect Commercial Insurance

NOVEMBER 1, 2024

Its primary purpose is to protect landlords from financial loss stemming from tenant-related incidents, property damage, and other rental-specific risks. It’s crucial because it ensures you won’t have to bear the financial burden of significant repairs out of pocket.

Property Insurance Centre

JANUARY 16, 2025

From the catastrophic floods in Carlisle in 2005 to the more recent deluge in London in 2021, businesses in flood-prone areas have faced disruption, financial losses, and complex insurance claims. Business Interruption: Compensation for lost income during downtime caused by flooding.

ProWriters

APRIL 3, 2024

Coverage of claims made by third parties who suffer financial losses due to the insured’s actions. In carrying E&O Insurance, professionals demonstrate they’re willing to take financial responsibility for any errors or omissions that may occur. Coverage of settlements or judgments awarded against the insured.

ProWriters

FEBRUARY 19, 2024

million , reflecting the immediate financial losses these incidents can inflict. In 2023, JD Sports suffered a data breach affecting 10 million customers, with undisclosed details of the financial impact. These incidents underscore the financial and reputational damage cyber attacks can inflict on retailers.

Jackson & Jackson

MARCH 18, 2024

The risks surrounding your precious bags are real, from theft to damage due to natural disasters. An insurance policy covering your luxury handbags ensures you are protected from financial loss in unforeseen circumstances. Check their track record, customer reviews, and financial stability.

Property Insurance Centre

MARCH 19, 2024

Insurance guides outline the various advantages of insurance coverage, emphasising how it protects against financial loss, provides peace of mind, and supports the recovery process after an incident. By educating policyholders about these key aspects, insurers ensure that policyholders are prepared and knowledgeable when a loss occurs.

Property Insurance Centre

JANUARY 4, 2024

Weather Conditions and Natural Disasters Since 1980, there have been 360 weather- and climate-related natural catastrophes , resulting in damages and costs of over $2.57 The frequency and severity of storms have been increasing, leading to higher property losses from tropical storms, wildfires, snowstorms, and flooding.

Protect Commercial Insurance

NOVEMBER 8, 2024

Understanding Commercial Insurance Commercial insurance is an essential part of safeguarding your business against unforeseen events that could lead to financial loss. It provides protection against a plethora of risks, including property damage, liability claims, theft, and even employee injuries.

Cover4LetProperty

APRIL 16, 2024

Depending on the policy, landlord insurance may also provide cover for loss of rental income if the property becomes uninhabitable due to an insured event, such as fire or flood. Overall, UK landlord insurance is tailored to meet the specific needs and risks faced by property owners who rent out their properties to tenants.

Protect Commercial Insurance

DECEMBER 6, 2024

Consequently, insurers broadened their products to protect against everything from product liability and professional indemnity to an array of workers’ compensations. With more frequent natural disasters like floods and wildfires, companies are increasingly vulnerable to physical damages and operational disruptions.

American Agents Alliance

SEPTEMBER 11, 2024

If the licensed business or individual fails to adhere to licensing laws, any injured party may recover damages from the surety that issued the bond up to the bond amount by filing a valid claim. Again, the principal on the bond (the contract) is ultimately financially liable for any valid claims.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content