A Comprehensive Guide to Understanding Commercial Property Insurance

Protect Commercial Insurance

APRIL 11, 2025

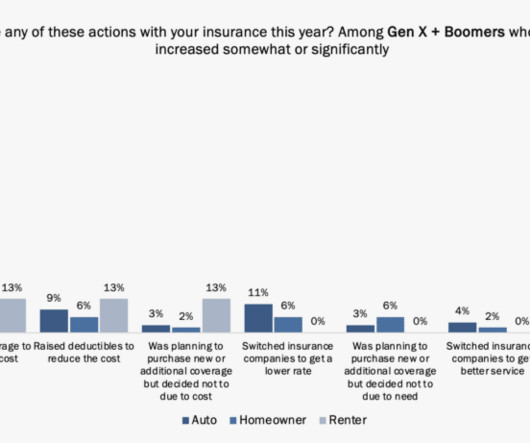

Does the local crime rate affect security? – Premiums and Deductibles : Clarify how much you need to pay and under what circumstances deductibles apply. To ensure adequate protection, its crucial to evaluate these risks carefully. – Industry-Specific Risks : Different industries face different challenges.

Let's personalize your content