Why Retail Cyber Security Must Include Cyber Insurance

ProWriters

JULY 30, 2025

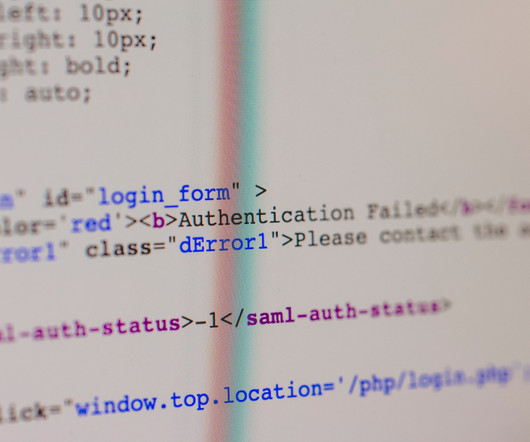

Unfortunately for retail cyber security , one 21st-century, technological “spider” hasn’t heeded the Bard’s warning. dollars) after a cyber attack, allegedly carried out by hacker group Scattered Spider, caused disruption to its online services. And this incident isn’t the only recent cyber attack in the U.K. million in U.S.

Let's personalize your content