Florida Insurance Regulators Demand Fair Treatment for Policyholders

Property Insurance Coverage Law

FEBRUARY 22, 2025

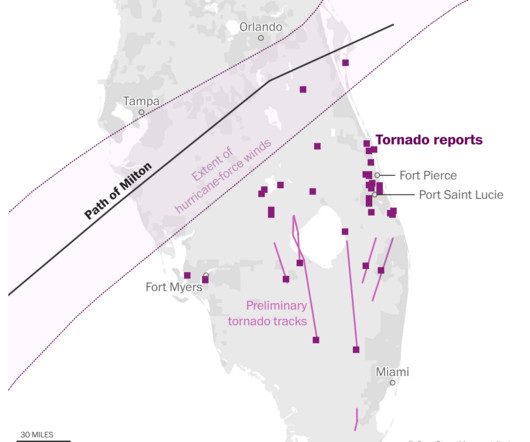

How do insurance claims work when your home has already been damaged once? A recent Florida Office of Insurance Regulation (OIR) Bulletin clarifies how insurers must handle claims for multiple hurricanes. But what happens when two hurricanes strike in the same season?

Let's personalize your content