New Triple-I Issue Brief Puts the Spotlight on Georgia’s Insurance Affordability Crisis

Triple-I: Homeowners Insurance

FEBRUARY 13, 2025

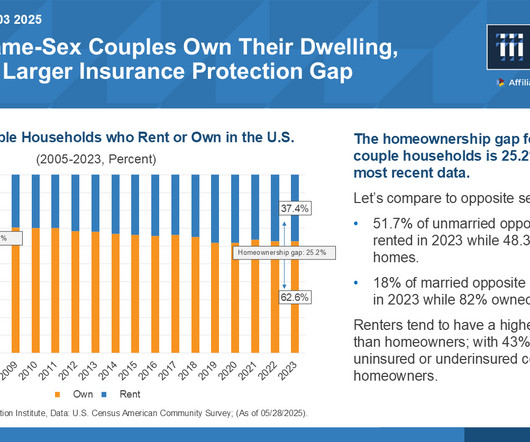

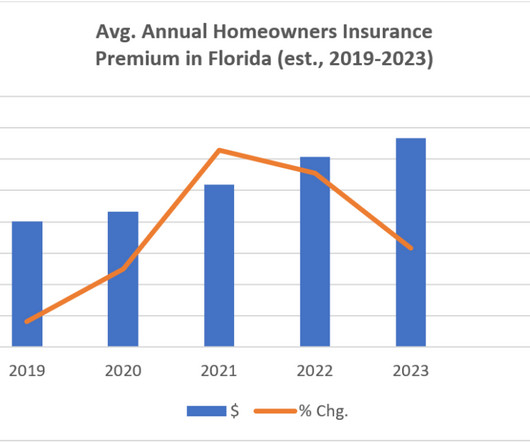

This brief provides an overview of how several factors, including skyrocketing costs from litigation, pose risks to coverage affordability, availability, and other potential economic outcomes for Georgia residents. Data indicates that litigation costs have become a pervasive concern for risk management.

Let's personalize your content