Insurance Affordability, Availability Demand Collaboration, Innovation

Triple-I: Homeowners Insurance

JUNE 19, 2025

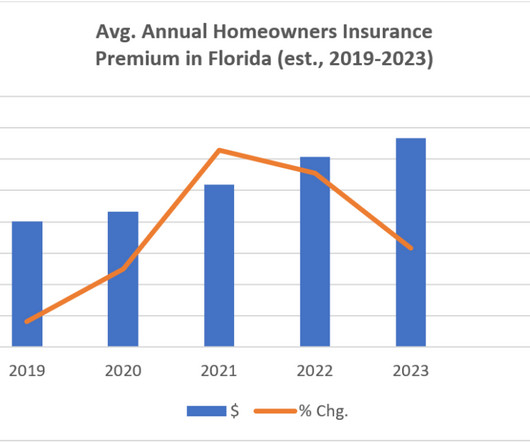

Triple-I CEO Sean Kevelighan in his opening remarks, noted that effective risk management depends on collaboration across stakeholder groups, as interconnected perils “present a community problem, not just an industry problem.” We’re talking about why premiums are where they are.” Who’s Financing Legal System Abuse?

Let's personalize your content