Viewpoint: Delegated Underwriting Authority Enterprises Offer Insurers Competitive Edge

Insurance Journal

FEBRUARY 4, 2025

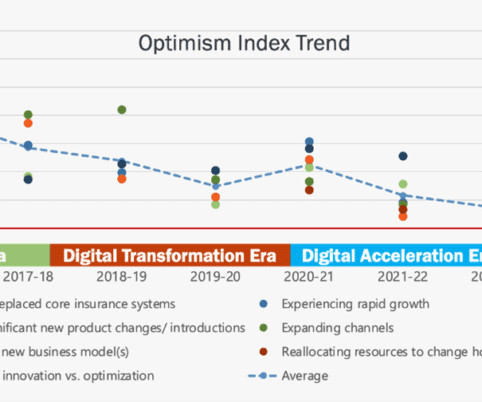

The growing adoption of data-driven underwriting and predictive analytics has given delegated underwriting authority enterprises (DUAEs) a competitive advantage within the insurance industry, with technology serving as a cornerstone for many of these operations. An AM Best survey of its …

Let's personalize your content