Helping Clients Navigate Marketplace Open Enrollment | Solstiuce

Solstice Insurance Broker

JANUARY 23, 2025

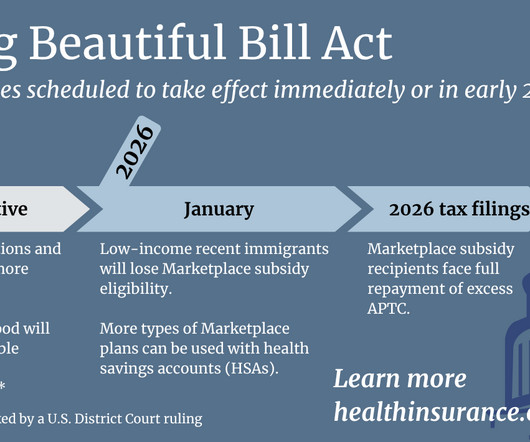

As an insurance broker, you can be the compass your clients need. The marketplace is essentially a virtual shopping center where individuals can compare and purchase health insurance plans. Open enrollment is the annual window during which people can enroll in or switch health insurance plans without a qualifying life event.

Let's personalize your content