What Agents Should Know About Tariffs and Insurance Costs

American Agents Alliance

APRIL 3, 2025

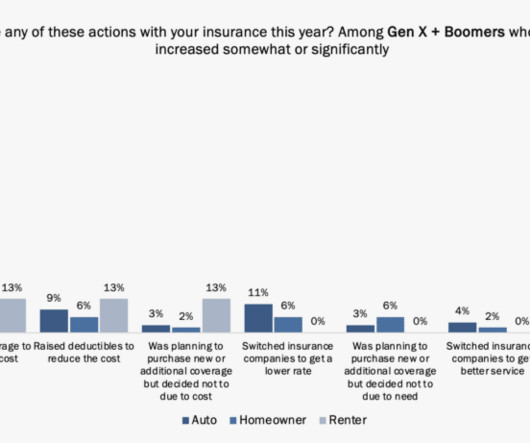

This drives up the cost to repair, impacting claims costs. Rising expenses could perhaps cause higher insured values, leading to policy adjustments and higher premiums. Auto parts are often manufactured overseas, even for US-made vehicles, which could drive up the cost of repair and in turn, cause rates to rise.

Let's personalize your content