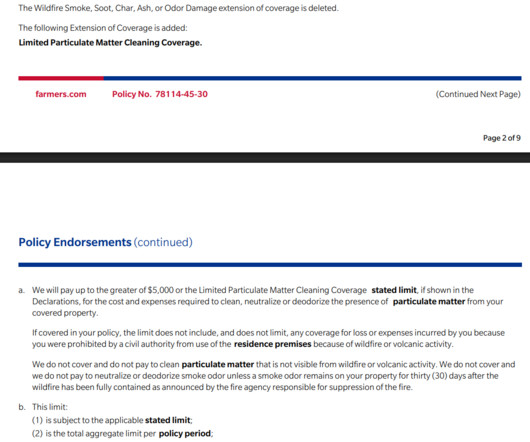

Insurance Is Not a Commodity: Don’t Buy the Cheap Farmers Homeowners Policy, Which Becomes Costly After a Fire

Property Insurance Coverage Law

JULY 21, 2025

In the aftermath of wildfires, when families are left sifting through ashes and trying to rebuild their lives, the true quality of an insurance policy comes sharply into focus. Too often, we hear from policyholders who thought they were adequately insured.

Let's personalize your content