Falling Work Comp Rates: The Good, the Bad, and the Ugly

R&R Insurance

FEBRUARY 20, 2025

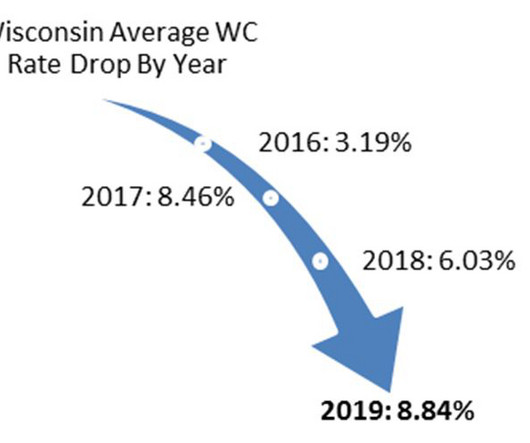

On October 1, 2024 Wisconsin continued its trend entering a ninth consecutive year of reduced workers compensation insurance rates. Workers compensation rates are state mandated in Wisconsin, meaning all insurance carriers must use the same rates resulting in premiums from one carrier to another are basically the same.

Let's personalize your content