Landlord Insurance vs. Standard Home Insurance: Key Differences

Protect Commercial Insurance

NOVEMBER 1, 2024

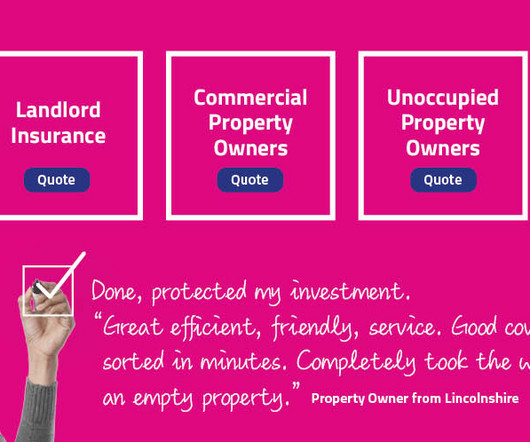

Whether you’re a landlord with several rental properties or a homeowner looking to safeguard your family home, understanding your insurance needs is essential. In this blog, we’ll explore the key differences between landlord insurance and standard home insurance. Who Needs Standard Home Insurance?

Let's personalize your content