The Ultimate Guide to Office Insurance: Protecting Your Business Assets

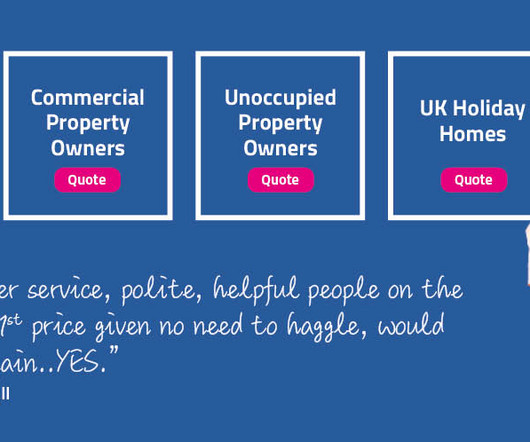

Protect Commercial Insurance

JUNE 20, 2025

Introduction to Office Insurance Running a successful business goes beyond offering excellent products or services—protecting your business assets is equally crucial. In the UK, office insurance provides peace of mind by protecting everything from furniture to essential equipment, making it a must-have for business owners.

Let's personalize your content