New Triple-I Issue Brief Puts the Spotlight on Georgia’s Insurance Affordability Crisis

Triple-I: Homeowners Insurance

FEBRUARY 13, 2025

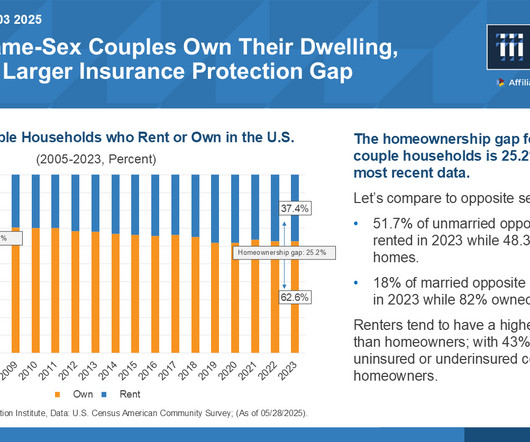

Tort reform is discussed as a legislative solution to the challenge of legal system abuse excessive policyholder or plaintiff attorney practices that increase costs and time to settle insurance claims. The five-year average count for liability claims increased 24.9 percent (2014 – 2018 at 583,756 vs. 2019-2023 at 729,191).

Let's personalize your content